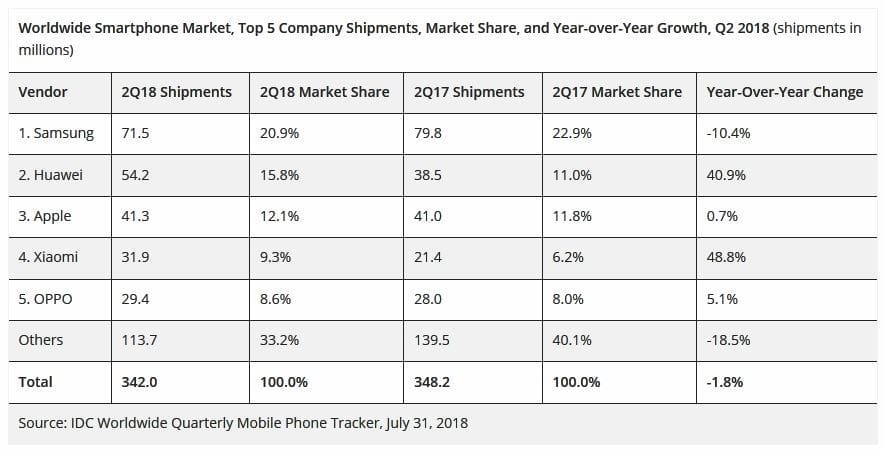

Huawei overtakes Apple to become second largest smartphone maker

According to IDC Worldwide Quarterly Mobile Phone Tracker, a total of 342 million units of smartphones were shipped in second quarter of 2018. This is less than 348.2 million smartphones shipped in Q2 2017, resulting in 1.8% decline. This is third straight deline Year-over-Year. Huawei and Xiaomi managed to make huge gain in shipments and this resulted in Huawei overtaking Apple. Samsung registered 10.1% decline but still is selling lot more smartphones than Huawei in second.

Even with the decline, Samsung managed to sell whopping 71.5 million smartphones last quarter. They state that the deline is mainly due to saturated market and not due to lacklustre S9 series sales. With the new J series phone turning out to be a big hit in India, we should expect Samsung to bounce back. Apple increased shipments by just 300,000 units and as a result, they registered 12.1% share, up from 11.8% but that is not enough to stop Huawei, which registered 15.8% share, up from 11.0% last year. This is the first time since 2Q2010 that Apple lost 2nd place.

“The continued growth of Huawei is impressive, to say the least, as is its ability to move into markets where, until recently, the brand was largely unknown,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers. “It is worth noting that Apple moved into the top position each of the last two holiday quarters following its product refresh, so it’s likely we’ll see continued movement among the top ranked companies in 2018 and beyond. For most markets, the ultra-high end ($700+) competition is largely some combination of Apple, Samsung, and Huawei, depending on the geography, and this is unlikely to change much in the short term. At the same time, Xiaomi, OPPO, and vivo are all slowly pushing their customer base upstream at a price tier slightly lower than the top three. This is an area they should all watch closely as the builds in this segment are getting increasingly more advanced.”

“The combination of market saturation, increased smartphone penetration rates, and climbing ASPs continue to dampen the growth of the overall market,” said Anthony Scarsella, research manager with IDC’s Worldwide Quarterly Mobile Phone Tracker. “Consumers remain willing to pay more for premium offerings in numerous markets and they now expect their device to outlast and outperform previous generations of that device which cost considerably less a few years ago. To contest this slowdown, vendors will need to focus on new innovative features and form factors combined with incentives and promotions to drive growth in many of these highly competitive markets moving forward.”