Gartner: Samsung slides, Apple and Chinese makers rise in 3Q2014

Gartner has announced their analysis of 3Q2014 smartphone and mobile phone market share and the report is pretty much in line with IDC’s report that we posted earlier this month. Samsung is on a downward spiral, Apple is on the rise and Chinese brands are taking the world by storm. We have a feeling that Samsung might go to record book as the last brand that had more than a quarter of market share as we are now slowly moving into an era where no particular brand will hold clear lead at the top. The best part here is that Smartphones, with 20.3% growth, accounted for 66% of global mobile phone market.

“Sales of feature phones declined 25 percent in the third quarter of 2014 because the difference in price between feature phones and low-cost Android smartphones is reducing further,” said Roberta Cozza, research director at Gartner. In the third quarter of 2014, smartphones accounted for 66 percent of the total mobile phone market, and Gartner estimates that by 2018, nine out of 10 phones will be smartphones.

The growth of smartphones in emerging markets continued to be explosive (nearly 50% of YoY growth while USA recorded highest growth among mature markets, with 18.9% increase of sales and this is mainly thanks to the release of new iPhones, the iPhone 6 and iPhone 6 Plus.

“Over the holidays we expect record sales of the iPhone 6 and iPhone 6 Plus, but we should not underestimate the Chinese vendors and local brands,” said Annette Zimmermann, research director at Gartner. “Chinese players will continue to look at expanding in overseas emerging markets. In Europe prepaid country markets and attractive lost-cost LTE phones will also offer key opportunities for these brands.” Gartner expects sales of smartphones to reach 1.2 billion units in 2014.

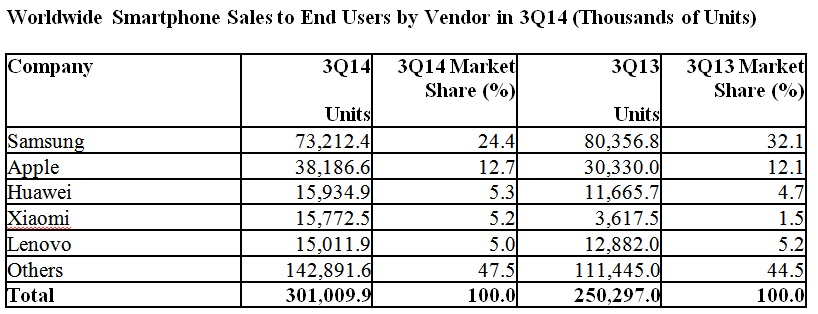

Worldwide Smartphone Sales to End Users by Vendor in 3Q14 (Thousands of Units)

| Company | 3Q14

Units |

3Q14 Market Share (%) | 3Q13

Units |

3Q13 Market Share (%) |

| Samsung | 73,212.4 | 24.4 | 80,356.8 | 32.1 |

| Apple | 38,186.6 | 12.7 | 30,330.0 | 12.1 |

| Huawei | 15,934.9 | 5.3 | 11,665.7 | 4.7 |

| Xiaomi | 15,772.5 | 5.2 | 3,617.5 | 1.5 |

| Lenovo | 15,011.9 | 5.0 | 12,882.0 | 5.2 |

| Others | 142,891.6 | 47.5 | 111,445.0 | 44.5 |

| Total | 301,009.9 | 100.0 | 250,297.0 | 100.0 |

Source: Gartner (December 2014)

While Smarpthone sales crossed 300 million barrier, registering 20% of growth QoQ, Samsung’s share fell by whopping 7.7%. Still, Samsung managed to hold a quarter of marketshare in smartphone sales. Major worry for Samsung is that they lost 28.6% of marketshare in China which, until last quarter was a major market. Apple came in second with 12.7% of marketshare (a slight incase of 0.6%) while Huawei, Xiaomi and Lenovo held on to remaining spots in top-5 list. The biggest growth here was for Xiaomi which had mere 1.5% of market in last quarter and thanks to its ‘aggressive expansion’ in Asia, registered 5% of marketshare. We may see Xiaomi to struggle in Q42014 as Ericsson managed to ban sales of Xiaomi smartphone sales in India as Xiaomi is reported to have violated SEP usage. The table looks so different, with the lag of the major global players like Motorola, LG, Sony, HTC and it looks like this is how it is going to be from here on.

With respect to Smartphone Operating System, Android still managed to increase its marketshare and is now holding 83.2% of marketshare. Apple’s iOS incrased the marketshare to 12.7%. Microsoft’s Windows managed to hang on to third place but saw the marketshare decline by 0.6%, to 3.0%. Blackberry stayed in fourth place with 0.8% marketshare, down from 1.8%. The new marketshare data should cause major worry for Microsoft and a way need to be found to make these Chinese smartphone manufacturers to adopt Windows Phone else it will be bye,bye Windows Phone.

Worldwide Smartphone Sales to End Users by Operating System in 3Q14 (Thousands of Units)

| Operating System | 3Q14

Units |

3Q14 Market Share (%) | 3Q13

Units |

3Q13 Market Share (%) |

| Android | 250,060.2 | 83.1 | 205,243 | 82.0 |

| iOS | 38,186.6 | 12.7 | 30,330 | 12.1 |

| Windows | 9,033.4 | 3.0 | 8,916 | 3.6 |

| Blackberry | 2,419.5 | 0.8 | 4,401 | 1.8 |

| Other OS | 1,310.2 | 0.4 | 1,407 | 0.6 |

| Total | 301,009.9 | 100.0 | 250,296.8 | 100.0 |

Source: Gartner (December 2014)

Finally, we see the brand ‘Nokia’. Thanks to the popular Asha series feature phones, Nokia managed to hang on to second spot in mobile phone marketshare but we may see Apple overtake Nokia and become second largest mobile phone maker (thanks to the super explosive growth of smartphones and decline in feature phone sales). Samsung held on to the top spot but their marketshare is now 20.6%, down from 25.7%. Nokia managed to get 9.5% marketshare, down from 13.8%. Apple, LG and Huawei took third, fourth and fifth places in the list.

“Samsung and Nokia experienced sharp double-digit declines in the third quarter, which let Apple get closer to Nokia, with only 5 million units separating these two vendors,” said Ms. Cozza. “The gap is also narrowing between the third and fourth positions, and the fourth quarter could be decisive for Huawei and LG.”

Worldwide Mobile Phone Sales to End Users by Vendor in 3Q14 (Thousands of Units)

| Company | 3Q14

Units |

3Q14 Market Share (%) | 3Q13

Units |

3Q13 Market Share (%) |

| Samsung | 94,017.8 | 20.6 | 117,060.8 | 25.7 |

| Nokia | 43,134.2 | 9.5 | 63,058.8 | 13.8 |

| Apple | 38,186.6 | 8.4 | 30,330.0 | 6.7 |

| LG Electronics | 18,976.8 | 4.2 | 18,046.3 | 4.0 |

| Huawei | 16,324.3 | 3.6 | 13,574.8 | 3.0 |

| TCL Communication | 15,955.5 | 3.5 | 13,311.0 | 2.9 |

| Xiaomi | 15,772.5 | 3.5 | 3,617.5 | 0.8 |

| Lenovo | 15,131.5 | 3.3 | 12,999.8 | 2.9 |

| ZTE | 13,857.6 | 3.0 | 13,697.3 | 3.0 |

| Micromax | 10,172.4 | 2.2 | 6,786.5 | 1.5 |

| Others | 174,255.4 | 38.2 | 163,223.8 | 35.8 |

| Total | 455,784.7 | 100.0 | 455,706.5 | 100.0 |

Source: Gartner (December 2014)